The level of inflation, the cost of debt, and property valuations are the variables that will have

the most influence on the financial performance of the Trust in the near term. Global economic

growth, the resilience of the Australian economy, the strength of the home improvement

and outdoor living sector, and the ongoing evolution and financial success of the Bunnings

business, will be more important for the Trust’s performance in the longer term.

1

ECONOMIC AND PROPERTY MARKET CONDITIONS

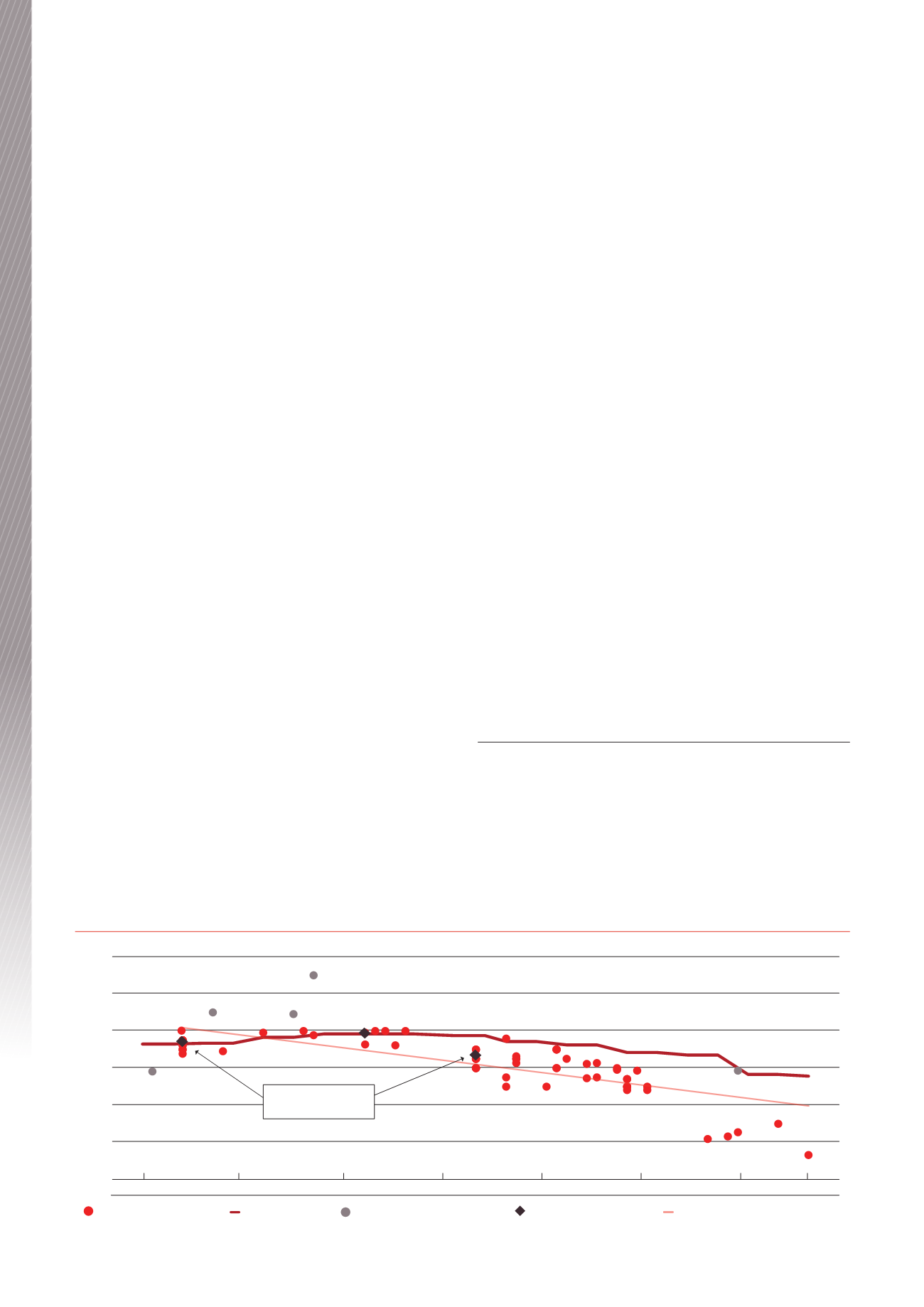

For the year ended 30 June 2016, there was strong investor

demand for Bunnings Warehouse properties, which resulted in

significant capitalisation rate compression, to a historical low,

as demonstrated in the chart below.

The extent to which property capitalisation rates tighten further is

likely to be a function of how long interest rates continue at current

levels, the growth outlook for the Australian economy, and the

global economic outlook generally. The current strength of the

property market is reflected in the value of the Trust’s portfolio at

30 June 2016, and will also continue to be a factor in property

acquisitions in the near term, which may limit portfolio growth while

these economic conditions prevail. The Trust will remain disciplined

in its investment approach to ensure it is best placed to create value

from any new property investments over the medium term.

The current low inflation rate, as measured by the Consumer Price

Index (“CPI”), will result in lower incremental growth of rental income

for the Trust in the near term. Approximately 62 per cent of the

Trust’s rental income is subject to CPI annual adjustment and

38 per cent is subject to fixed annual adjustments, other than in

years in which respective properties are due for a market rent review

(typically every five years for most of the Trust’s existing portfolio).

For the year ended 30 June 2016, the average CPI increase for

leases in the portfolio was 1.6 per cent, which applied to annual

escalations for leases comprising 57 per cent of the rental income for

properties subject to a review during the year (“base rent”). For the

year ending 30 June 2017, CPI reviews will apply to 53 per cent

of the base rent, with leases subject to a market rent review

comprising 10 per cent of the base rent, and with the balance of

37 per cent reviewed to fixed increases of three to four per cent.

The level of income growth the Trust derives from market rent

reviews will depend on property specific factors and what relevant

evidence is available from time to time for comparable Bunnings

Warehouses or other comparable properties. It is therefore difficult

to predict the likely growth from market rent reviews, particularly

when often the outcome of individual market reviews is the subject

of a binding determination by an independent expert.

HOME IMPROVEMENT RETAIL SECTOR PERFORMANCE

AND GROWTH

The strength and outlook for the home improvement and outdoor

living market in Australia and the ongoing financial success

of the Bunnings business is important for the future financial

performance of the Trust.

Bunnings is continuing to deliver solid organic growth, with 8.0

per cent like-for-like sales growth for the nine month period

ended 31 March 2016

2

, reflecting the strength of its business

model, and the resilience of the home improvement and outdoor

living market in general.

1

This outlook contains forward-looking statements and assumptions. Please

refer to the Important notice on the inside cover of this report

2

Source: Wesfarmers third quarter results announcement, 21 April 2016, page 3

OUTLOOK

Capitalisation rate trends for Bunnings properties

PortfolioTransactionAvg Cap Rate

BWPPortfolio Cap Rate

NewBunnings StoreTransactions (Trend Line)

Dec-10

6%

5%

4%

7%

8%

9%

10%

Oct-11

Jul-12

May-13

Mar-14

Jan-15

Nov-15

Jun-16

NewBunnings StoreTransactions

Secondary Market BunningsTransactions

Bunnings Portfolio

Acquisitions by BWP

BWP Trust Annual Report 2016

12

Business Review