BWP TRUST ANNUAL REPORT 2015

43

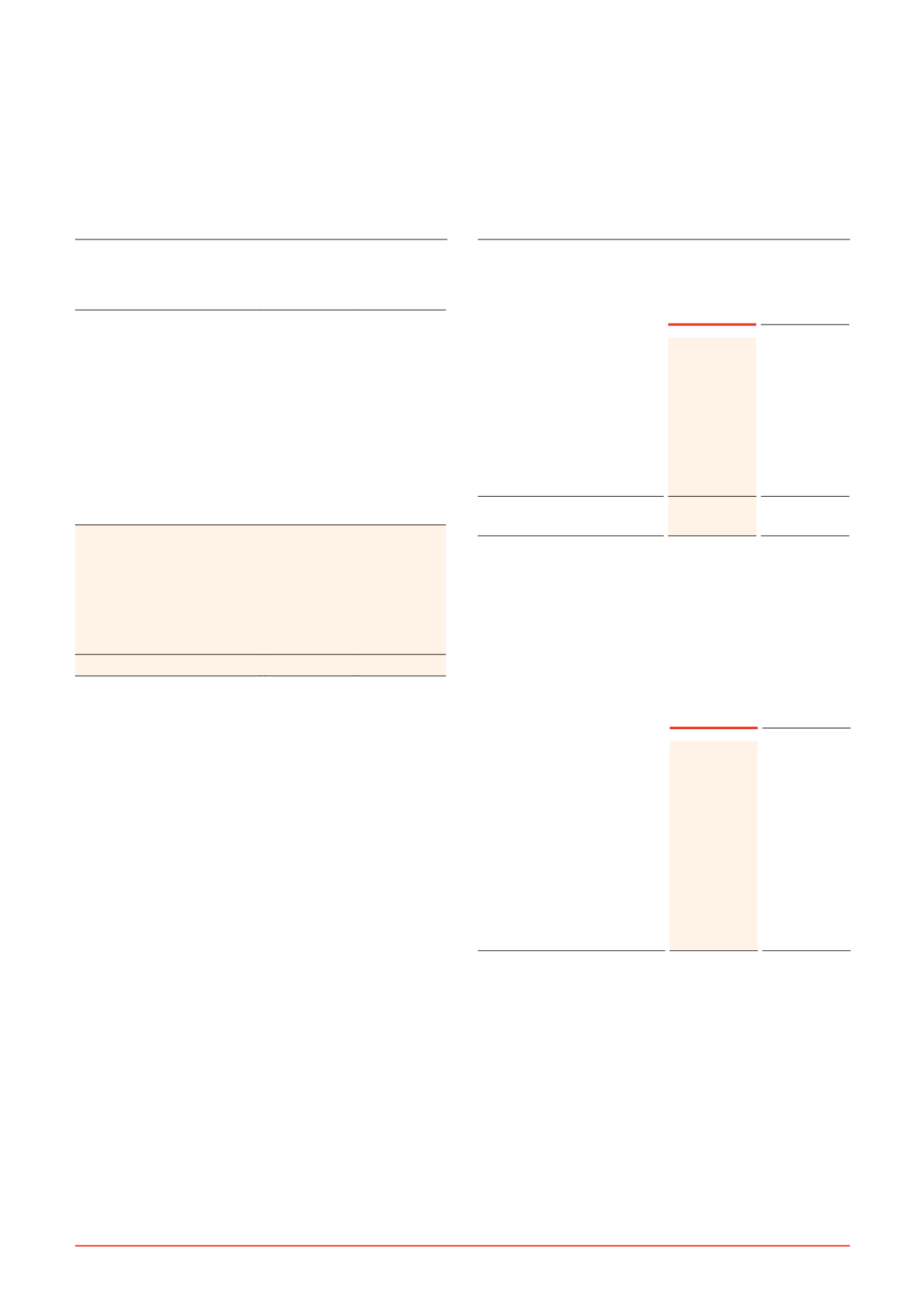

10. ISSUED CAPITAL

Movement in units on issue

$000 Number of units

At 1 July 2013

707,363 537,753,954

Issue of units – DRP:

-

-

August 2013 at

$2.3387 per unit

5,583

2,387,450

-

-

February 2014 at

$2.2176 per unit

16,032

7,229,276

Issue of units -

pro-rata entitlement offer at

$2.30 per unit

200,156

87,024,515

Expenses incurred in

pro-rata entitlement offer

(4,348)

-

At 30 June 2014 and

1 July 2014

924,786 634,395,195

Issue of units – DRP:

-

-

August 2014 at

$2.4937 per unit

13,290

5,329,631

-

-

February 2015 at

$2.8137 per unit

7,482

2,658,977

At 30 June 2015

945,558 642,383,803

Recognition and measurement

Units on issue

Units on issue are recognised at the fair value of the consideration

received by the Trust. Any transaction costs arising on the issue of

ordinary units are recognised directly in equity as a reduction of the

unit proceeds received.

Rights

The Trust is a unit trust of no fixed duration and the units in the Trust

have no right of redemption.

Each unit entitles the unitholder to receive distributions as declared

and, in the event of winding up the Trust, to participate in all net cash

proceeds from the realisation of assets of the Trust in proportion to the

number of and amounts paid up on units held.

Distribution Reinvestment Plan

The Trust operates a Distribution Reinvestment Plan (“DRPâ€). The DRP

was in place for both the interim distribution and final distribution for

the year ended 30 June 2015 and the preceding year. An issue of

units under the DRP results in an increase in issued capital unless the

units are acquired on-market.

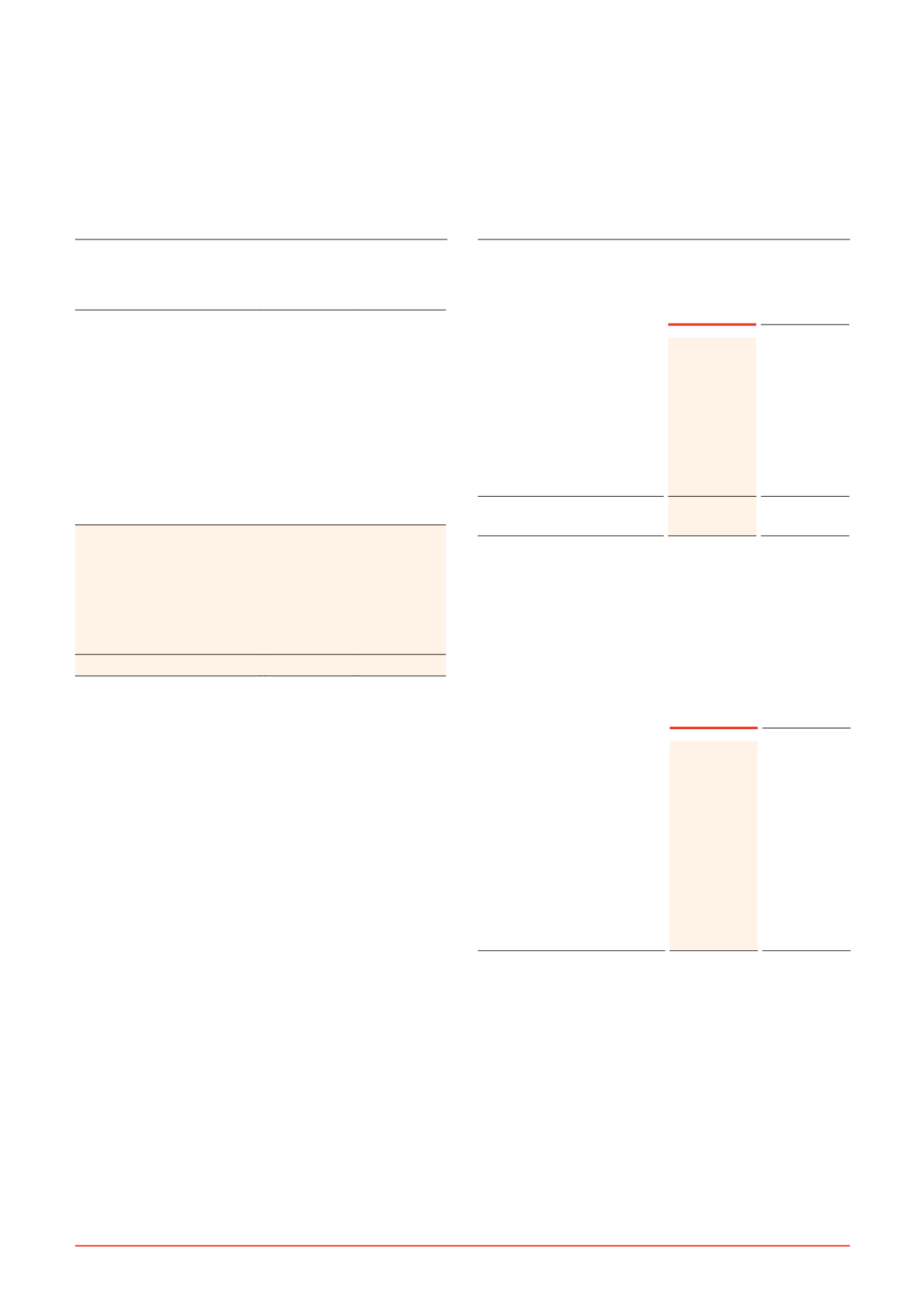

11. HEDGE RESERVE

June 2015

$000

June 2014

$000

Balance at the beginning of the

financial year

(12,047)

(12,516)

Effective portion of changes in fair

value of cash flow hedges:

-

-

Realised losses transferred to

profit or loss

5,290

5,421

-

-

Unrealised losses on cash flow

hedges

(4,186)

(4,952)

Balance at the end of the

financial year

(10,943)

(12,047)

Recognition and measurement

This reserve records the portion of the gain or loss on a hedging

instrument in a cash flow hedge that is determined to be an

effective hedge.

12. EARNINGS PER UNIT

June 2015

June 2014

Net earnings used in

calculating basic and diluted

earnings per unit ($000)

210,079

149,081

Basic and diluted earnings

per unit (cents)

32.84

24.34

Basic and diluted earnings per

unit excluding gains in fair value

of investment properties (cents)

15.88

15.01

Weighted average number

of units on issue used in the

calculation of basic and diluted

earnings per unit

639,766,648 612,563,010

Recognition and measurement

Earnings per unit

Basic earnings per unit is calculated as net profit attributable to

unitholders divided by the weighted average number of units.

The diluted earnings per unit is equal to the basic earnings per unit.