DIRECTORS’ REPORT

FOR THE YEAR ENDED 30 JUNE 2016

In accordance with the Corporations Act 2001, BWP Management

Limited (ABN 26 082 856 424), the responsible entity of BWP Trust,

provides this report for the financial year that commenced 1 July 2015

and ended 30 June 2016. The information on pages 1 to 25 forms part

of this Directors’ report and is to be read in conjunction with the following

information:

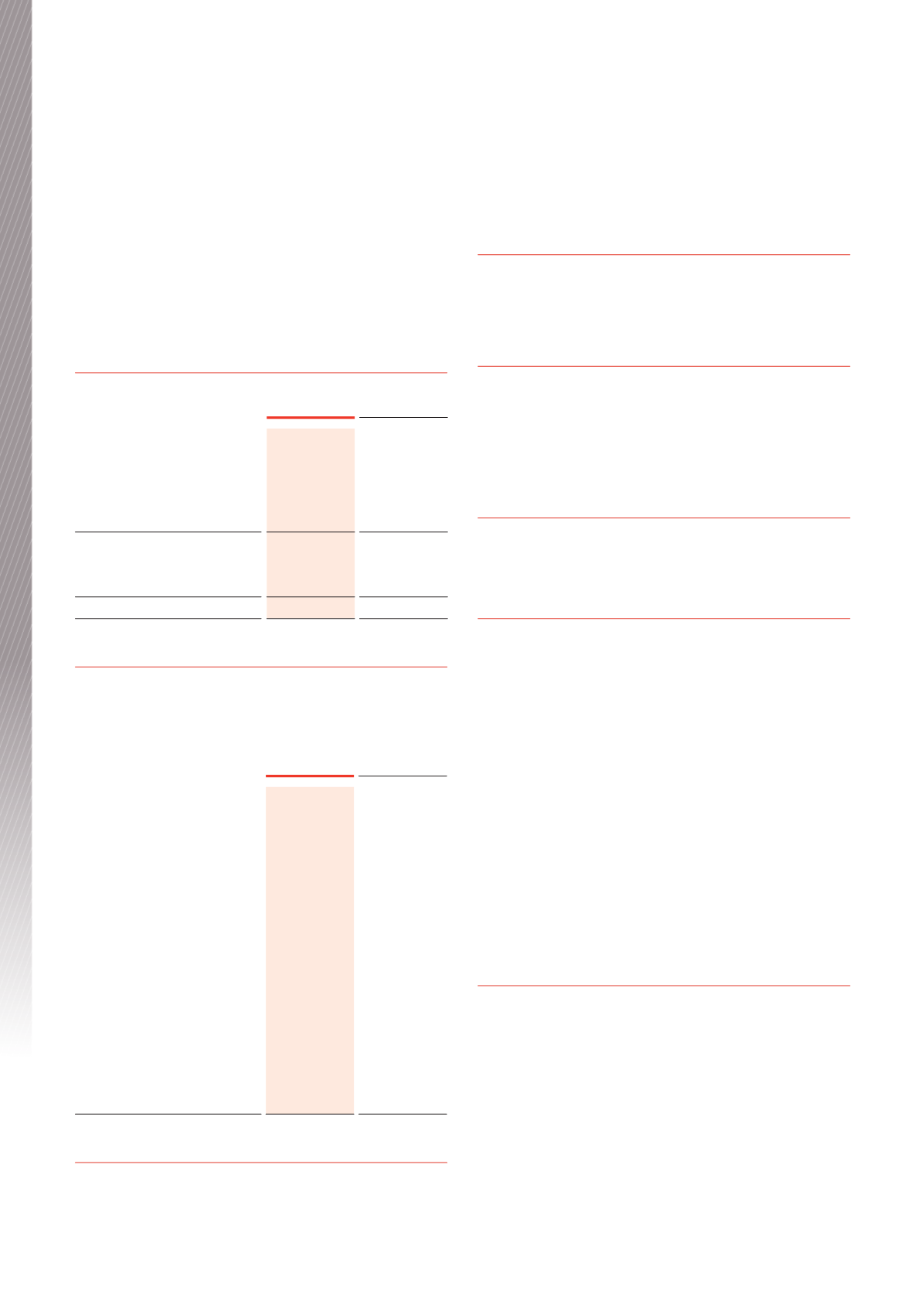

RESULTS AND DISTRIBUTIONS

June 2016

$000

June 2015

$000

Profit attributable to unitholders

of BWP Trust

310,504

210,079

Realised gains on disposal of

investment properties

-

(371)

Net unrealised gains in fair value

of investment properties

(202,633)

(108,137)

Distributable profit for the year

107,871

101,571

Opening undistributed profit

22

1

Closing undistributed profit

(36)

(22)

Distributable amount

107,857

101,550

DISTRIBUTIONS

The following distributions have been paid by the Trust or declared by

the directors of the responsible entity since the commencement of the

financial year ended 30 June 2016:

June 2016

$000

June 2015

$000

(a) Out of the profits for the

year ended 30 June 2015 on

ordinary units as disclosed in

last year’s Directors’ report:

(i) Final distribution of 8.17

cents per ordinary unit

paid on 27 August 2015

52,483

49,991

(b) Out of the profits for the year

ended 30 June 2016 (see

Note 8 of the notes to the

financial statements):

(i) Interimdistribution of 8.29

cents per ordinary unit

paid on 25 February 2016

53,254

49,067

(ii) Final distribution of

8.50 cents per ordinary

unit declared by the

directors for payment on

25 August 2016

54,603

52,483

UNITS ON ISSUE

At 30 June 2016, 642,383,803 units of BWP Trust were on issue

(2015: 642,383,803).

PRINCIPALACTIVITY

The principal activity is property investment.

There has been no significant change in the nature of this activity

during the financial year.

TRUSTASSETS

At 30 June 2016, BWP Trust held assets to a total value of $2,200.5

million (2015: $2,018.0 million). The basis for valuation of investment

properties which comprises the majority of the value of the Trust’s

assets is disclosed in Note 6 of the notes to and forming part of the

financial statements.

FEE PAID TO THE RESPONSIBLE ENTITYAND

ASSOCIATES

Management fees totalling $11,793,442 (2015: $11,071,092) were paid

or payable to the responsible entity out of Trust property during the

financial year.

TRUST INFORMATION

BWP Trust is a Managed Investment Scheme registered in Australia.

BWP Management Limited, the responsible entity of the Trust, is

incorporated and domiciled in Australia and holds an Australian

Financial Services Licence. The responsible entity’s parent company

and ultimate parent company is Wesfarmers Limited.

The registered office of the responsible entity is Level 11,

40 The Esplanade, Perth, Western Australia, 6000. The principal

administrative office of the responsible entity is Level 6, 40 The

Esplanade, Perth, Western Australia, 6000.

The Trust had no employees during the financial year (2015: nil).

Management services are provided to the responsible entity by

Wesfarmers Limited. Wesfarmers Limited employees seconded to

the responsible entity to provide management services to the Trust

are engaged in dedicated roles to act exclusively for the responsible

entity on behalf of the Trust and are paid directly by Wesfarmers

Limited. Short-term incentives paid by Wesfarmers Limited to

employees engaged by the responsible entity are based entirely on

the performance of the Trust and furthering the objectives of the Trust.

DIRECTORS

Information on directors

Mr E Fraunschiel (Chairman)

Ms F E Harris

Mr R D Higgins

Mr AJ Howarth

Mr MJ G Steur

Mr MJWedgwood (Managing Director)

Mr J KAtkins (resigned 31 August 2015)

Mr J AAustin (retired 2 December 2015)

Details of the current directors appear on page 25.

No director is a former partner or director of the current auditor of the Trust,

at a time when the current auditor has undertaken an audit of the Trust.

BWP Trust Annual Report 2016

46

Financial Report