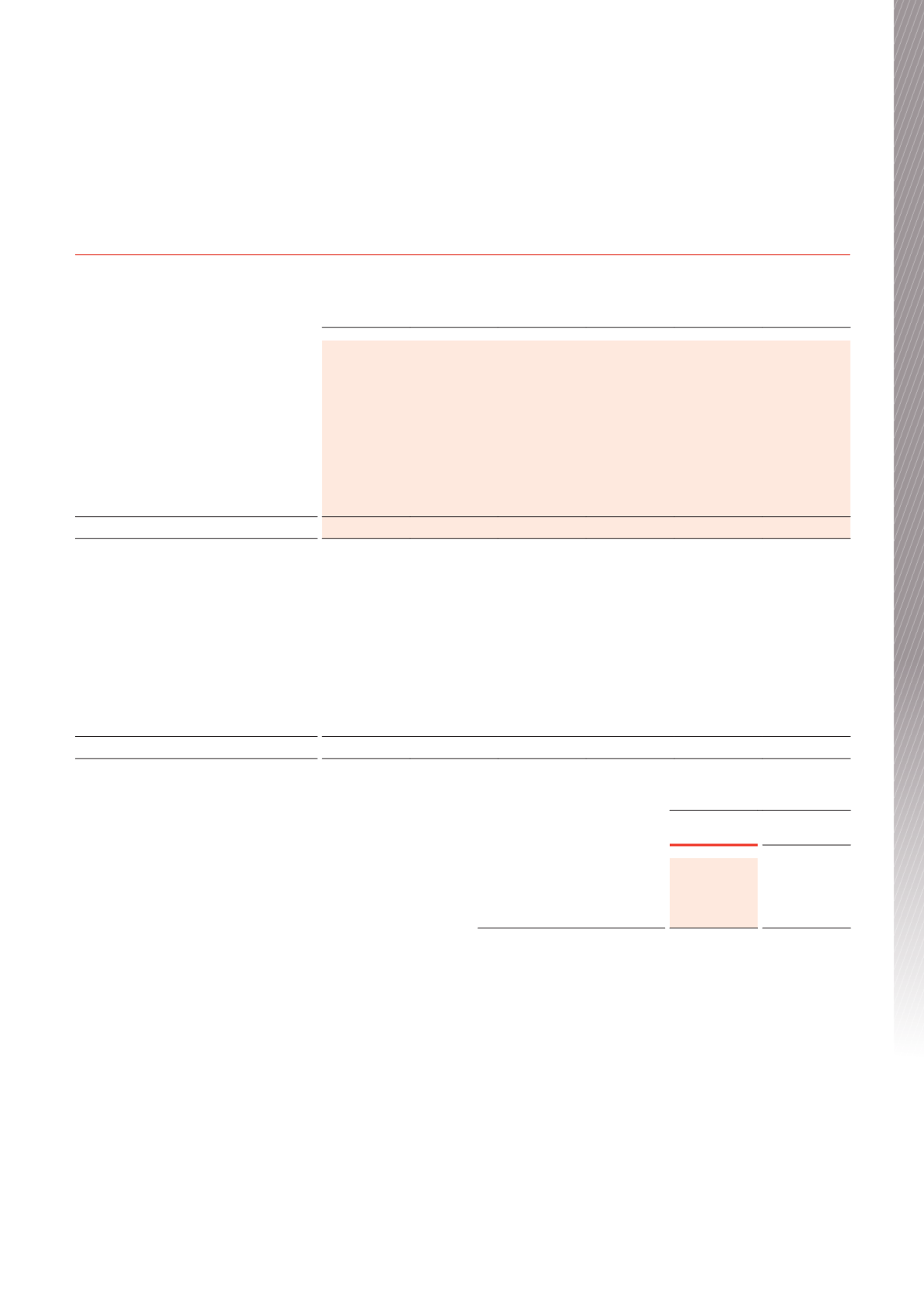

13. FINANCIAL RISK MANAGEMENT (CONTINUED)

Carrying

amount

$000

Contractual

cash flows

$000

1 year

$000

1-2 years

$000

2-5 years

$000

More than

5 years

$000

30 June 2016

Non-derivative financial liabilities

Bank loans - principal

(272,300)

(272,300)

-

(81,400)

(190,900)

-

Bank loans - future interest

-

(26,970)

(6,733)

(8,268)

(11,969)

-

Corporate bonds

(200,033)

(227,000)

(9,000)

(9,000)

(209,000)

-

Payables and deferred income

(18,206)

(18,206)

(18,206)

-

-

-

Derivative financial liabilities

Interest rate swaps

(9,978)

(9,759)

(3,290)

(3,170)

(3,131)

(168)

(500,517)

(554,235)

(37,229)

(101,838)

(415,000)

(168)

30 June 2015

Non-derivative financial liabilities

Bank loans - principal

(285,700)

(285,700)

-

-

(193,500)

(92,200)

Bank loans - future interest

-

(42,439)

(9,289)

(9,204)

(23,602)

(344)

Corporate bonds

(199,701)

(236,000)

(9,000)

(9,000)

(218,000)

-

Payables and deferred income

(27,363)

(27,363)

(27,363)

-

-

-

Derivative financial liabilities

Interest rate swaps

(10,943)

(11,400)

(4,295)

(3,520)

(3,389)

(196)

(523,707)

(602,902)

(49,947)

(21,724)

(438,491)

(92,740)

c) Interest rate risk

Interest rate risk is the risk that the Trust’s finances will be adversely

affected by fluctuations in interest rates. To help reduce this risk in

relation to bank loans, the Trust has employed the use of interest

rate swaps whereby the Trust agrees with various banks to exchange

at specified intervals, the difference between fixed rate and floating

rate interest amounts calculated by reference to an agreed notional

principal amount. Any amounts paid or received relating to interest rate

swaps are recognised as adjustments to interest expense over the life

of each contract swap, thereby effectively fixing the interest rate on the

underlying obligations.

At 30 June 2016 the fixed rates varied from 2.39 per cent to 5.54 per

cent (2015: 3.10 per cent to 5.70 per cent) and the floating rates were

at bank bill rates plus a bank margin.

The Trust has a policy of hedging the majority of its borrowings against

interest rate movements to ensure stability of distributions. At 30

June 2016, the Trust’s hedging cover (interest rate swaps and fixed

rate corporate bonds) was 79 per cent of borrowings. This level is

currently above the Board’s preferred 50 per cent to 75 per cent range

due to the corporate bond issuance in late May 2014. Hedging levels

are expected to return within the Board’s preferred range as existing

interest rate swaps mature.

The Trust’s exposure to interest rate risk for classes of financial assets

and financial liabilities is set out as follows:

Carrying amount

June 2016

$000

June 2015

$000

Variable rate instruments

Cash and short-term deposits

14,029

32,445

Bank debt facilities

(272,300)

(285,700)

The Trust’s sensitivity to interest rate movements

Fair value sensitivity analysis for fixed rate instruments

The Trust does not account for any fixed-rate financial assets or financial

liabilities at fair value through the profit or loss. Therefore, a change in

interest rates at the reporting date would not affect profit or loss.

Cash flow sensitivity analysis for variable rate instruments

The analysis below considers the impact on equity and net profit or

loss due to a reasonably possible increase or decrease in interest

rates. This analysis assumes that all other variables remain constant.

The same comparative analysis has been applied to the 2015

financial year.

BWP Trust Annual Report 2016

41

Financial Report