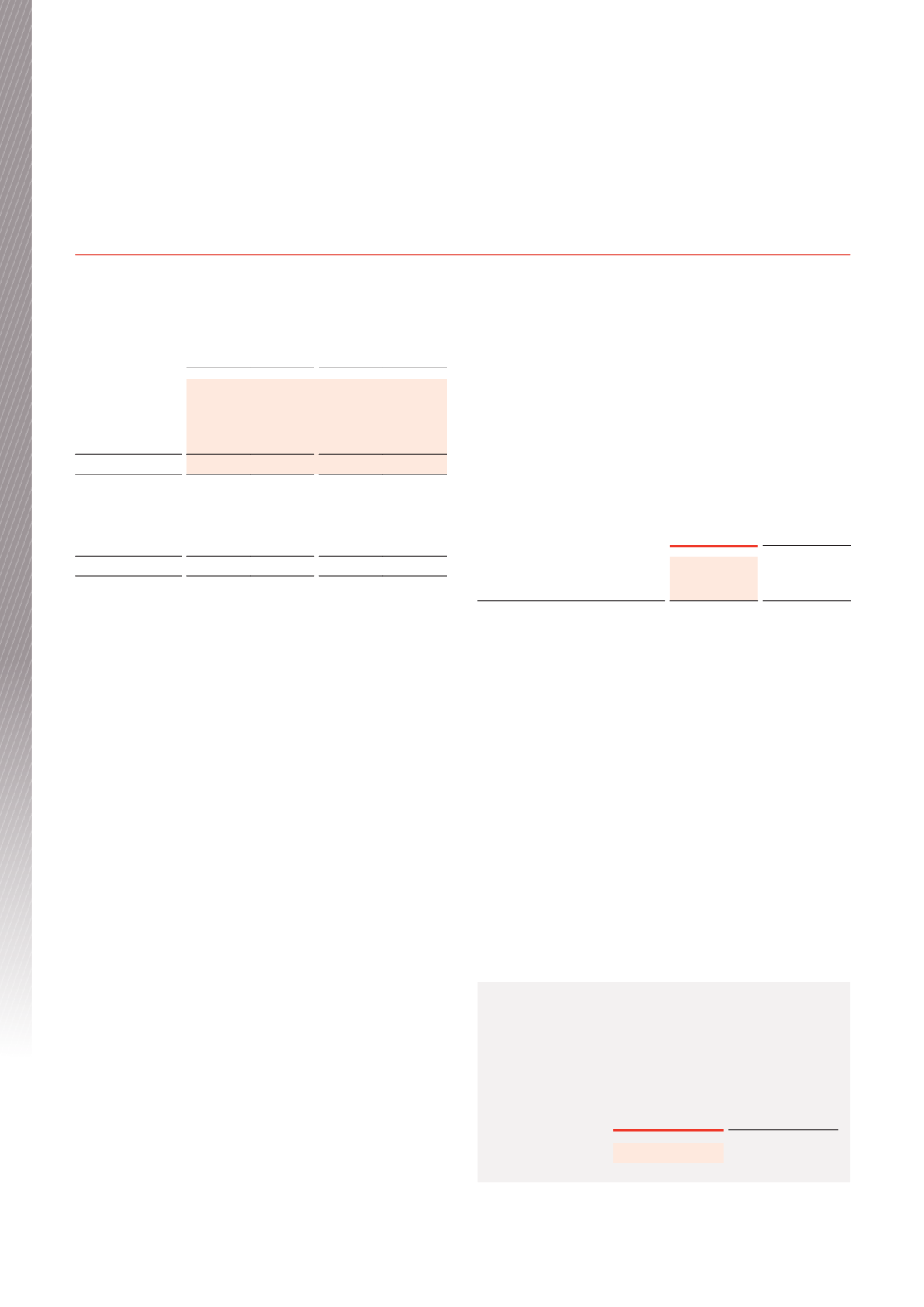

13. FINANCIAL RISK MANAGEMENT (CONTINUED)

Impact on Net profit

Impact on Equity

50 basis

points

increase

$000

50 basis

points

decrease

$000

50 basis

points

increase

$000

50 basis

points

decrease

$000

30 June 2016

Variable rate

instruments

(1,362)

1,362

-

-

Interest rate swaps

875

(875)

2,615 (2,680)

Net impact

(487)

487

2,615 (2,680)

30 June 2015

Variable rate

instruments

(1,429)

1,429

-

-

Interest rate swaps

900

(900)

2,196 (2,235)

Net impact

(529)

529

2,196 (2,235)

Derivative financial instruments

As detailed on the previous page, the Trust enters into derivative

financial instruments in the form of interest rate swap agreements,

which are used to convert the variable interest rate of its borrowings

to fixed interest rates. For the purpose of hedge accounting, these

hedges are classified as cash flow hedges. The swaps are entered

into with the objective of reducing the risk associated with interest

rate fluctuations.

The portion of the gain or loss on the hedging instrument that

is determined to be an effective hedge is recognised in other

comprehensive income and any ineffective portion is considered

a finance cost and is recognised in profit or loss in the statement

of profit or loss and other comprehensive income. The cumulative

gain or loss previously recognised in other comprehensive income

and presented in the hedging reserve in equity remains there until

the forecast transaction affects profit or loss, at which point it is

transferred to profit or loss.

If the hedging instrument no longer meets the criteria for hedge

accounting, expires or is sold, terminated or exercised, then hedge

accounting is discontinued prospectively.

The Trust manages its financial derivatives (interest rate swaps) to

ensure they meet the requirements of a cash flow hedge.

d) Capital management

Capital requirements are assessed based on budgeted cash flows,

capital expenditure commitments and potential growth opportunities

and are monitored on an ongoing basis. Information on capital

and equity markets is reviewed on an ongoing basis to ascertain

availability and cost of various funding sources.

In order to maintain a manageable level of debt, the responsible entity

has established a preferred range of 20 to 30 per cent for the Trust’s

gearing ratio (debt to total assets), which is monitored on a monthly

basis. At 30 June 2016, the gearing level was 21.5 per cent (2015:

24.1 per cent).

The DRP was in place for both the interim distribution and final

distribution for the year ended 30 June 2016 and the preceding year.

e) Fair values

The fair values and carrying amounts of the Trust’s financial assets and

financial liabilities recorded in the financial statements are materially

the same with the exception of the following:

June 2016

$000

June 2015

$000

Corporate bonds – book value

(200,033)

(199,701)

Corporate bonds – fair value

(209,087)

(206,743)

The methods and assumptions used to estimate the fair value of

financial instruments are as follows:

Loans and receivables, and payables and deferred income

Due to the short-term nature of these financial rights and obligations,

their carrying amounts are estimated to represent their fair values.

Cash and short-term deposits

The carrying amount is fair value due to the liquid nature of these assets.

Bank debt facilities and corporate bonds

Market values have been used to determine the fair value of corporate

bonds using a quoted market price. The fair value of bank debt

facilities have been calculated by discounting the expected future cash

flows at prevailing interest rates using market observable inputs.

Interest rate swaps

Interest rate swaps are measured at fair value by valuation techniques

for which all inputs which have a significant effect on the recorded fair

value are observable, either directly or indirectly (Level 2).

Key judgement

Interest rates used for determining fair value

The interest rates used to discount estimated cash flows,

where applicable, are based on current market rates for

similar instruments and were as follows:

June 2016

June 2015

Interest rate swaps

1.83% to 2.42%

2.15% to 3.62%

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

BWP Trust Annual Report 2016

42

Financial Report