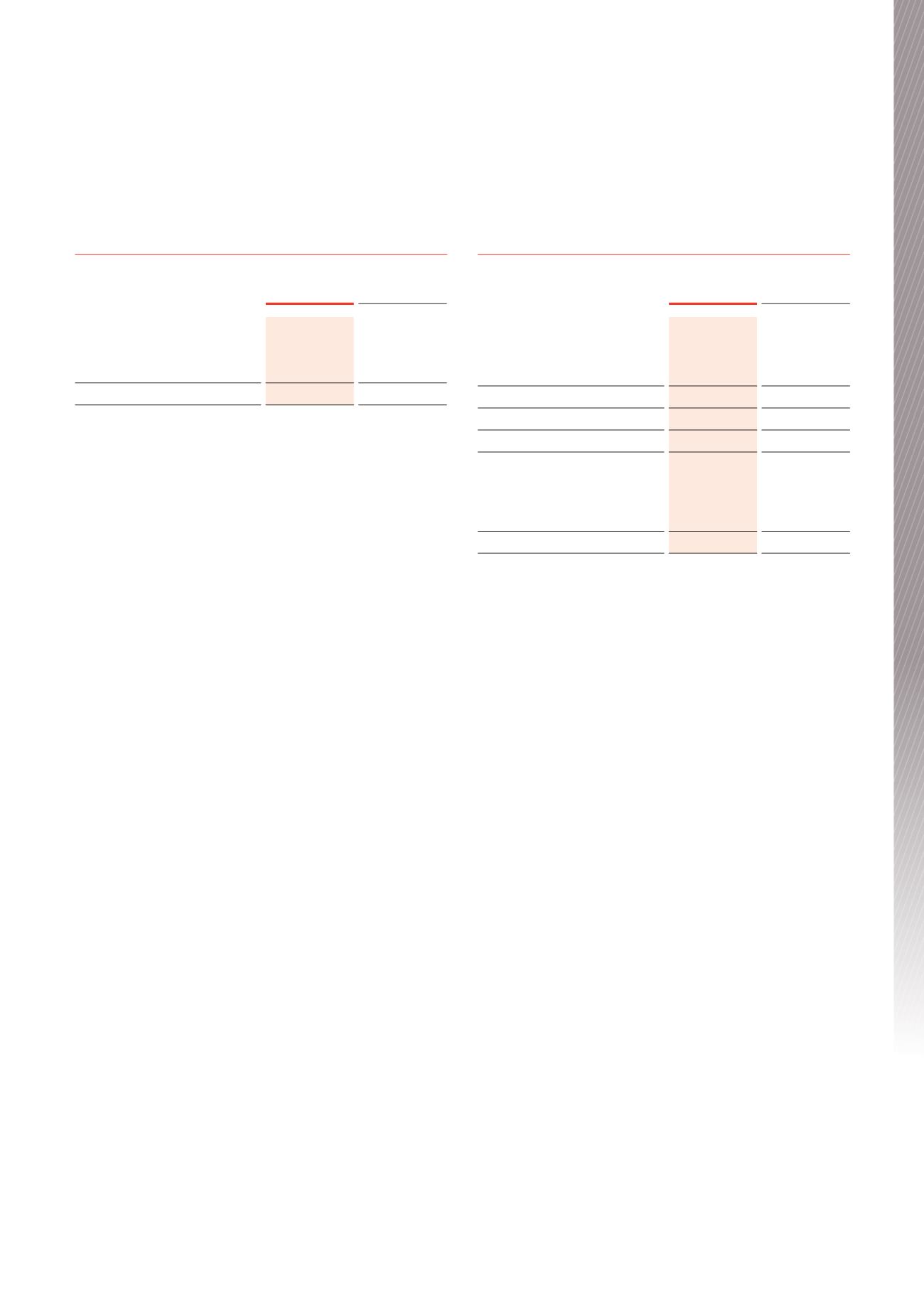

1. REVENUE

June 2016

$000

June 2015

$000

Rental income

149,219

142,533

Other property income

861

2,088

Finance income

116

256

Revenue

150,196

144,877

Recognition and measurement

Revenue is recognised to the extent that it is probable that the

economic benefits will flow to the entity and the revenue can be

reliably measured using the following criteria:

Rental and other property income

Rental and other property income is recognised at the amount and

when due under the terms of the lease. All fixed, Consumer Price

Indices-linked and market rent review increases are recognised in

income from the date that these are due in accordance with the

respective lease terms. This is done to ensure that rental income is

matched with the associated cash flows over the term of the lease.

Finance income

Finance income is interest income on bank deposits and is recognised

as the interest accrues, using the effective interest method.

2. EXPENSES

June 2016

$000

June 2015

$000

Interest expense on bank debt

facilities

19,334

20,526

Interest expense on interest rate

swaps

4,981

5,290

Finance costs

24,315

25,816

Responsible entity’s fees

11,793

11,071

Non-recoverable property costs

1

5,477

5,733

Listing and registry expenses

442

396

Other

298

290

Other operating expenses

6,217

6,419

1

Included in non-recoverable property costs are amounts paid or payable of

$2,177,969 (2015: $2,302,207) for Queensland Land Tax which under the

respective state legislation when the lease was entered into cannot be on-

charged to tenants.

Recognition and measurement

Finance costs

Finance costs are recognised as an expense when incurred, with

the exception of interest charges on funds invested in properties

with substantial development and construction phases, which are

capitalised to the property until such times as the construction work is

complete.

The capitalisation rate used to determine the amount of finance costs

to be capitalised is the weighted average interest rate applicable to the

Trust’s outstanding borrowings during the year.

Responsible entity’s fees

The responsible entity, BWP Management Limited, is entitled to a

management fee payable quarterly in arrears of 0.55 per cent per

annum of the gross asset value of the Trust.

The responsible entity is also entitled to a fee calculated at the rate

of 0.05 per cent per annum of the gross asset value of the Trust up to

$200 million and 0.035 per cent per annum of the amount by which

the gross asset value of the Trust exceeds $200 million.

The responsible entity may waive the whole or any part of the

remuneration to which it would otherwise be entitled (see Note 16).

BWP Trust Annual Report 2016

33

Financial Report