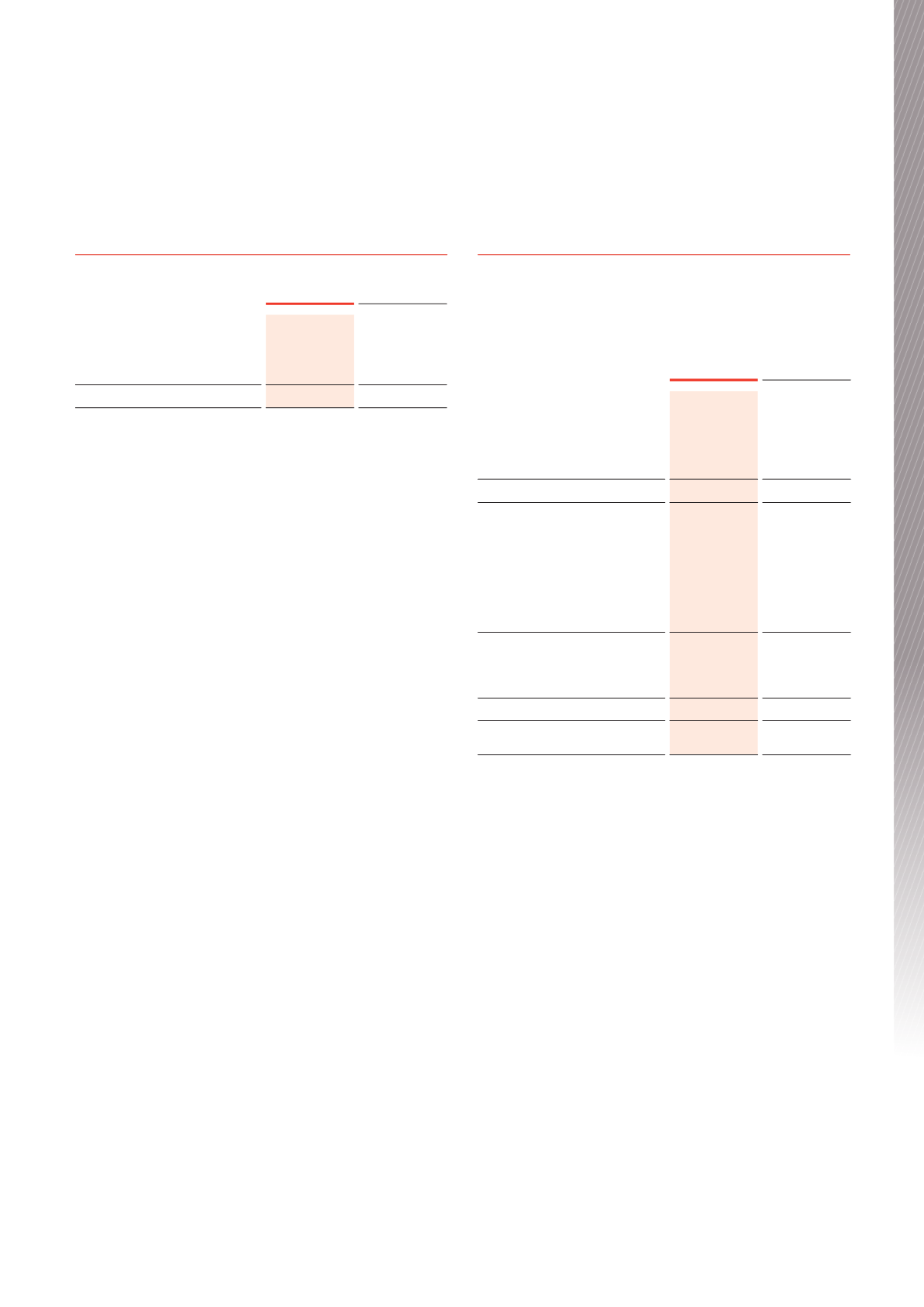

7. PAYABLES AND DEFERRED INCOME

June 2016

$000

June 2015

$000

Trade creditors and accruals

4,441

14,084

Responsible entity’s fees payable

3,246

3,139

Rent received in advance

10,519

10,140

18,206

27,363

Recognition and measurement

Liabilities are recognised for amounts to be paid in the future for goods

and services received, whether or not these have been billed to the

Trust. These liabilities are normally settled on 30 day terms except for

the responsible entity’s fees payable, which are settled quarterly in

arrears, and retention monies withheld on construction projects which

are settled according to the terms of the construction contracts.

The Trust’s exposure to liquidity risk in respect of payables is disclosed

in Note 13.

8. DISTRIBUTIONS PAID OR PAYABLE

In accordancewith the Trust’s constitution, the unrealised gains or losses

on the revaluation of the fair value of investment properties are not included

in the profit available for distribution to unitholders, as well as other items as

determined by the directors. A reconciliation is provided below:

June 2016

$000

June 2015

$000

8.29 cents (2015: 7.67 cents) per

unit, interim distribution paid on

25 February 2016

53,254

49,067

8.50 cents (2015: 8.17 cents) per

unit, final distribution provided

54,603

52,483

107,857

101,550

Profit attributable to unitholders

of BWP Trust

310,504

210,079

Realised gains on disposal of

investment properties

-

(371)

Net unrealised gains in fair value

of investment properties

(202,633)

(108,137)

Distributable profit for the year

107,871

101,571

Opening undistributed profit

22

1

Closing undistributed profit

(36)

(22)

Distributable amount

107,857

101,550

Distribution (cents per unit)

16.79

15.84

Recognition and measurement

Each reporting period the directors of the responsible entity are

required to determine the distribution entitlement of the unitholders in

respect of the period. Any amounts so determined but not paid by the

end of the period, are recorded as a liability.

The recording of the distribution payable at each reporting date as a

current liability may result in the Trust’s current liabilities exceeding its

current assets. This is a timing issue, as the Trust repays its interest-

bearing loans and borrowings during the period from net profit and

draws down its interest-bearing loans and borrowings when the

distribution payments are made in August and February of each year.

BWP Trust Annual Report 2016

37

Financial Report