6. INVESTMENT PROPERTIES

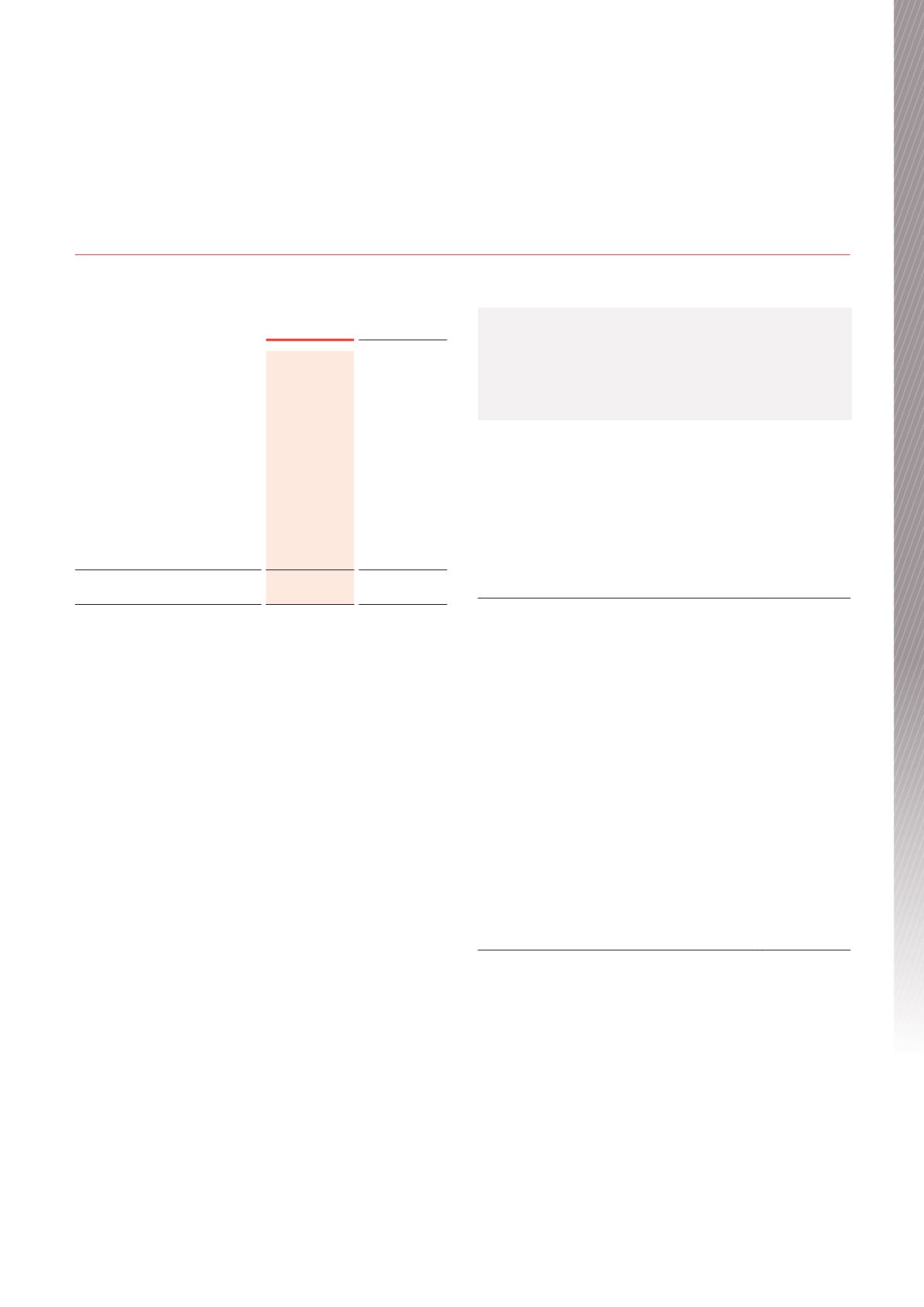

Reconciliation of the carrying amount of investment properties:

June 2016

$000

June 2015

$000

Balance at the beginning

of the financial year

1,964,915

1,765,480

Acquisitions during the year

211

117,322

Divestments during the year

(7,519)

(17,366)

Reclassification to assets

held for sale

(3,093)

(16,357)

Capital improvements since

acquisition

7,553

7,328

Realised gains on disposal of

investment properties

-

371

Net unrealised gains from

fair value adjustments

202,633

108,137

Balance at the end of the

financial year

2,164,700

1,964,915

Recognition and measurement

Investment property is initially measured at cost and subsequently at

fair value with any change therein recognised in profit and loss.

Subsequent revaluations to fair value according to the Trust’s

revaluations policy may result in transaction costs appearing as a

negative adjustment (loss) in fair value.

Where assets have been revalued, the potential effect of the capital

gains tax (“CGT”) on disposal has not been taken into account in the

determination of the revalued carrying amount. The Trust does not

expect to be ultimately liable for CGT in respect of the sale of assets as

all realised capital gains would be distributed to unitholders.

Fair value – Hierarchy

The Trust is required to categorise the fair value measurement of

investment properties based on the inputs to the valuations technique

used. All investment properties for the Trust have been categorised on

a Level 3 fair value basis as some of the inputs required to value the

properties are not based on “observable market data”.

Fair value – Valuation approach

Key judgement

The Trust has a process for determining the fair value of

investment properties at each balance date, applying generally

accepted valuation criteria, methodology and assumptions

detailed below.

An independent valuer, having an appropriate professional

qualification and recent experience in the location and category of

property being valued, values individual properties every three years

on a rotation basis. The independent valuer determines the most

appropriate valuation method for each property (refer below).

In accordance with the Trust’s policy, the following properties were

independently valued at 30 June 2016:

Property

Valuation $000

Arundel

34,600

Bethania

27,900

Bibra Lake

24,000

Broadmeadows

28,300

Ellenbrook

30,300

Frankston

31,500

Geraldton

17,600

Geraldton Showrooms

3,050

Manly West

33,600

North Lakes

41,800

Oakleigh South

18,500

Rydalmere

51,000

Springvale

32,700

Sunbury

29,300

Thornleigh

18,700

Wagga Wagga

19,100

Properties that have not been independently valued as at balance date

are carried at fair value by way of directors’ valuation.

The directors adopt the following valuation methodologies for all

remaining properties, and these methodologies are subject to an

independent review process by Jones Lang LaSalle.

BWP Trust Annual Report 2016

35

Financial Report