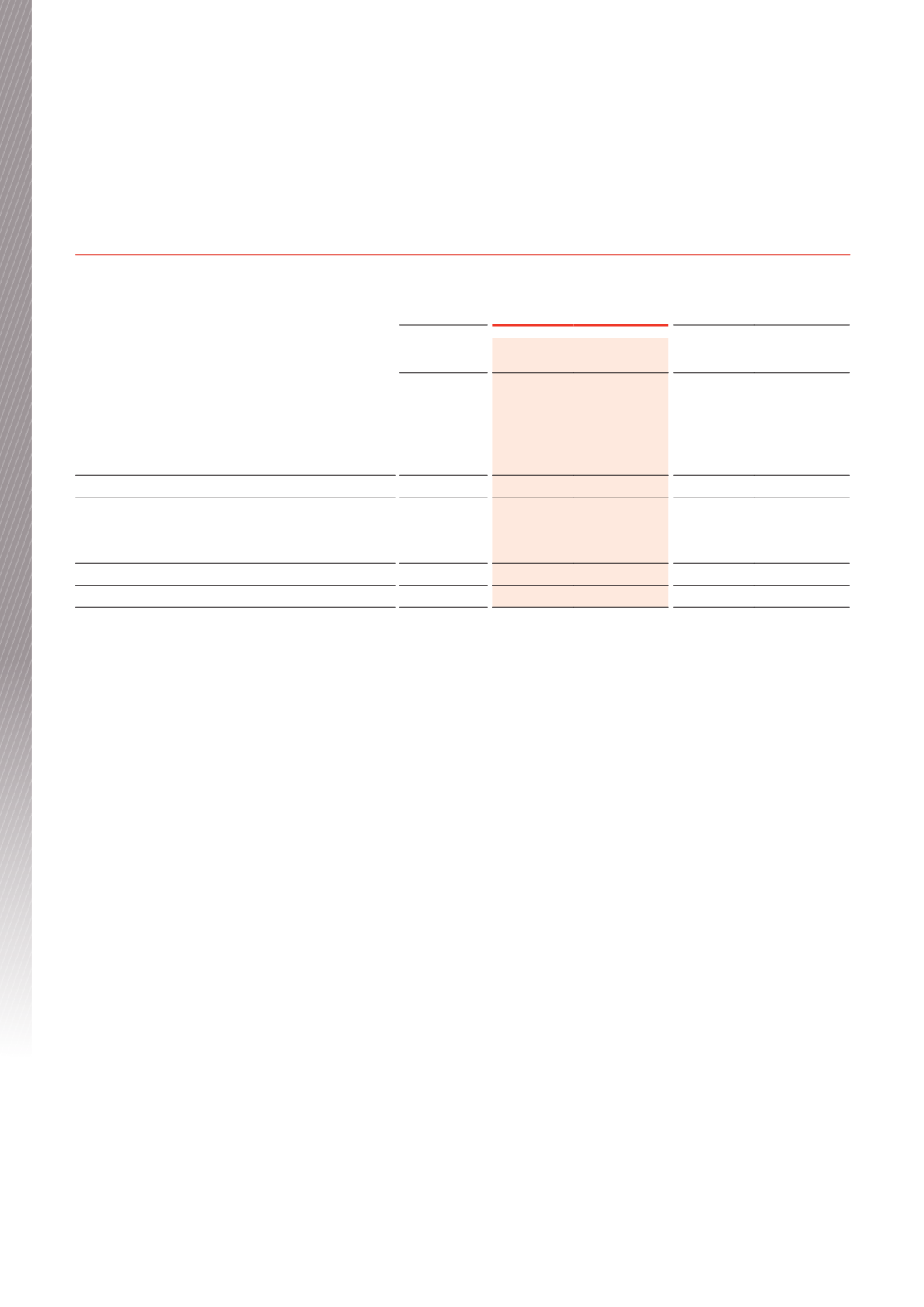

9. INTEREST-BEARING LOANS AND BORROWINGS

As at 30 June 2016 the Trust had the following borrowings:

June 2016

June 2015

Expiry date

Limit

$000

Amount drawn

$000

Limit

$000

Amount drawn

$000

Bank debt facilities

Australia and New Zealand Banking Group Limited

1 July 2018

110,000

81,400

110,000

94,300

Commonwealth Bank of Australia

31 July 2020

110,000

85,200

110,000

92,200

Westpac Banking Corporation

30 April 2020

135,000

105,700

135,000

99,200

355,000

272,300

355,000

285,700

Corporate bonds

Fixed term five-year corporate bond

27 May 2019

200,000

200,000

200,000

200,000

Accrued/(prepaid) interest and borrowing costs

33

(299)

200,000

200,033

200,000

199,701

555,000

472,333

555,000

485,401

Recognition and measurement

The borrowings under the facilities are not secured by assets of the

Trust, but are subject to reporting and financial undertakings by the

Trust to the banks under negative pledge agreements with each bank.

Interest-bearing loans and borrowings

All interest-bearing loans and borrowings are initially recognised at

the fair value of the consideration received less directly attributable

transaction costs.

After initial recognition, interest-bearing loans and borrowings are

subsequently measured at amortised cost using the effective interest

method. Fees paid on the establishment of loan facilities that are

interest-bearing are included as part of the carrying amount of loans

and borrowings.

Borrowings are classified as non-current liabilities if the Trust has an

unconditional right to defer settlement of the liability for at least 12

months after the balance date.

Refer to Note 13 for information on interest rate and liquidity risk.

At 30 June 2016 the minimum duration of the above debt facilities

was 24 months (2015: 36 months) and the maximum was 49 months

(2015: 61 months) with a weighted average duration of 38.6 months

(2015: 50.3 months).

Corporate bonds

On 27 May 2014, the Trust issued $200 million fixed rate domestic

bonds maturing on 27 May 2019. Interest is payable semi-annually in

arrears on the fixed rate domestic bonds, at 4.58 per cent per annum.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

BWP Trust Annual Report 2016

38

Financial Report