13. FINANCIAL RISK MANAGEMENT

The Trust holds financial instruments for the following purposes:

Financing:

to raise funds for the Trust’s operations. The principal

types of instruments are term advances (“bank loans”), bank bills and

corporate bonds.

Operational:

the Trust’s activities generate financial instruments

including cash, trade receivables and trade payables.

Risk management:

to reduce risks arising from the financial

instruments described above, including interest rate swaps.

The Trust’s holding of these instruments exposes it to risk. The Board

of directors of the responsible entity has overall responsibility for the

establishment and oversight of the Trust’s policies for managing these

risks, which are outlined below:

>> credit risk (note 13(a));

>> liquidity risk (note 13(b)); and

>> interest rate risk (note 13(c)).

These risks affect the fair value measurement applied by the Trust,

which is discussed further in note 13(e).

a) Credit risk

Credit risk is the risk of financial loss to the Trust if a customer or

counterparty to a financial instrument fails to meet its contractual

obligations, and arises principally from the Trust’s receivables

from customers, cash, and payments due to the Trust under

interest rate swaps.

Receivables

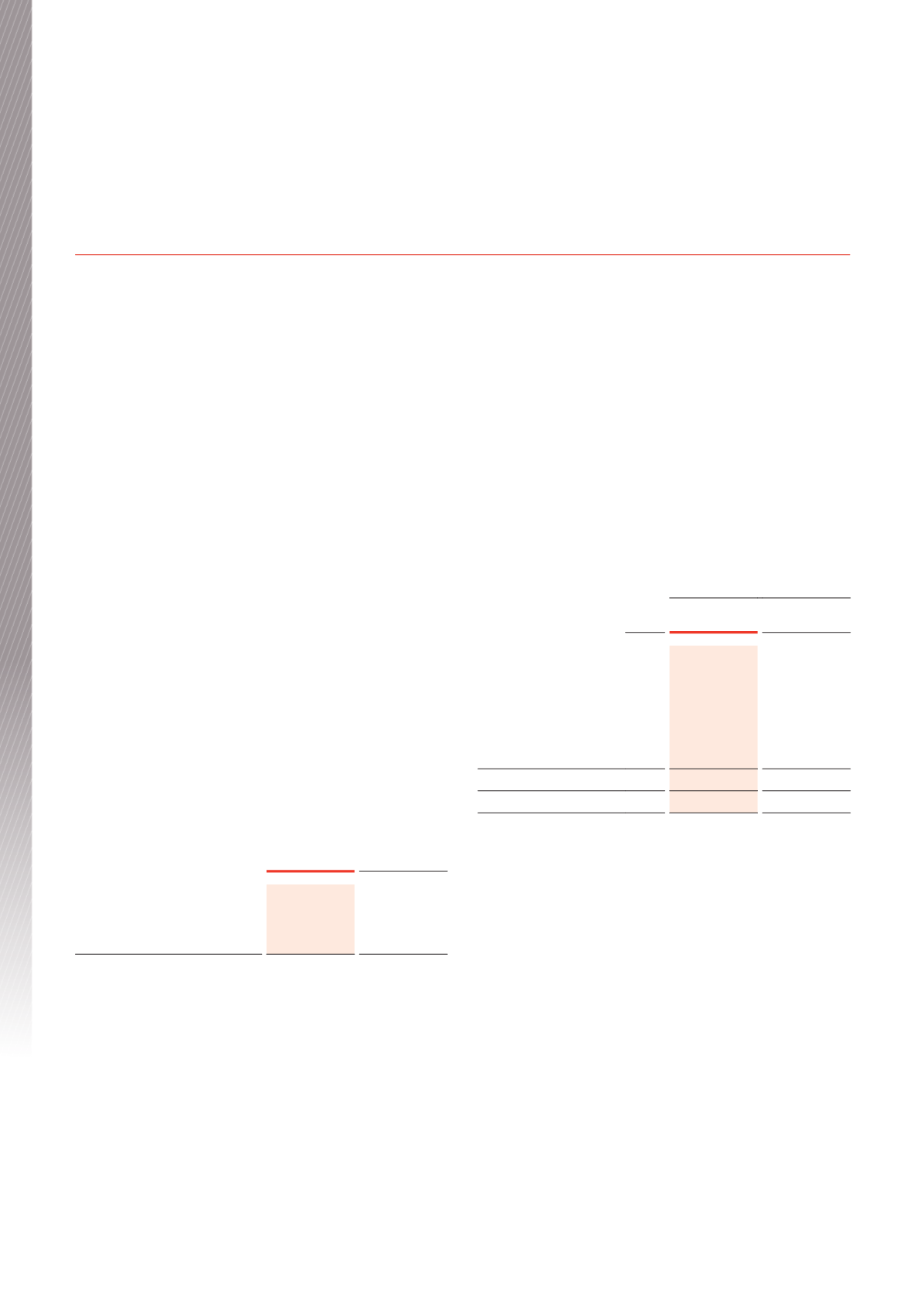

The credit risk associated with 93.5 per cent (2015: 93.7 per cent)

of the rental income is with three tenants.

June 2016

June 2015

Bunnings Group Limited

1

92.5

92.3

Officeworks Superstores Pty Ltd

1

0.6

0.9

J Blackwood and Son Pty Limited

1

0.4

0.5

1

Wholly owned subsidiaries of Wesfarmers limited

Bunnings Group Limited, J Blackwood and Son Pty Limited,

Officeworks Superstores Pty Ltd and Wesfarmers Limited are

currently subject to a Deed of Cross Guarantee under which they

covenant with a trustee for the benefit of each creditor that they

guarantee to each creditor payment in full of any debt in the event

of any entity that is included in the Deed of Cross Guarantee being

wound up. Wesfarmers Limited has been assigned a credit rating of

A-(stable)/A2 by Standard & Poor’s (A3 (Stable)/P2 – Moody’s).

Cash

The Trust limits its exposure to credit risk associated with its cash by

maintaining limited cash balances and having cash deposited with

reputable, major financial institutions subject to regulation in Australia,

which are rated A- or higher by Standard and Poor’s.

Derivative financial instruments

The Trust limits its exposure to credit risk associated with future

payments from its interest rate swaps by contracting with reputable

major financial institutions subject to regulation in Australia, which are

rated A- or higher by Standard and Poor’s.

Exposure to credit risk

The carrying amount of the Trust’s financial assets represents the

maximum credit exposure. The Trust’s maximum exposure to credit

risk at the reporting date was:

Carrying amount

Note

June 2016

$000

June 2015

$000

Cash and short-term

deposits

3

14,029

32,445

Receivables

Wesfarmers Limited

subsidiaries

4

227

842

Other tenants

4

409

193

636

1,035

Total exposure

14,665

33,480

b) Liquidity risk

Liquidity risk is the risk that the Trust will not be able to meet its financial

obligations as they fall due.

To assist in minimising the risk of having inadequate funding for the

Trust’s operations, the Trust’s objective is to maintain a balance between

continuity of funding and flexibility through the use of bank loans and

corporate bonds with different tenures, with the Trust aiming to spread

maturities to avoid excessive refinancing in any period. In respect to the

Trust’s bank loans, whilst these have fixed maturity dates, the terms of

these facilities allow for the maturity period to be extended by a further

year each year subject to the amended terms and conditions being

accepted by both parties. The Trust also regularly updates and reviews

its cash flow forecasts to assist in managing its liquidity.

Maturity of financial liabilities

The following are the contractual maturities of financial liabilities

(including estimated interest payments) and receipts or payments of

interest rate swaps. The amounts disclosed in the table below are the

contractual undiscounted cash flows and hence will not necessarily

reconcile with the amount disclosed in the statement of financial position.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

BWP Trust Annual Report 2016

40

Financial Report